NEW!

지속가능한 혁신을 누가 주도하고 있습니까?

LexisNexis® PatentSight+의 데이터를 활용한 WIPO의 새로운 특허 동향 보고서는 UN 지속 가능한 개발 목표를 지원하는 데 누가 앞장서고 있는지 보여줍니다.

이사회에 IP로 제언하기

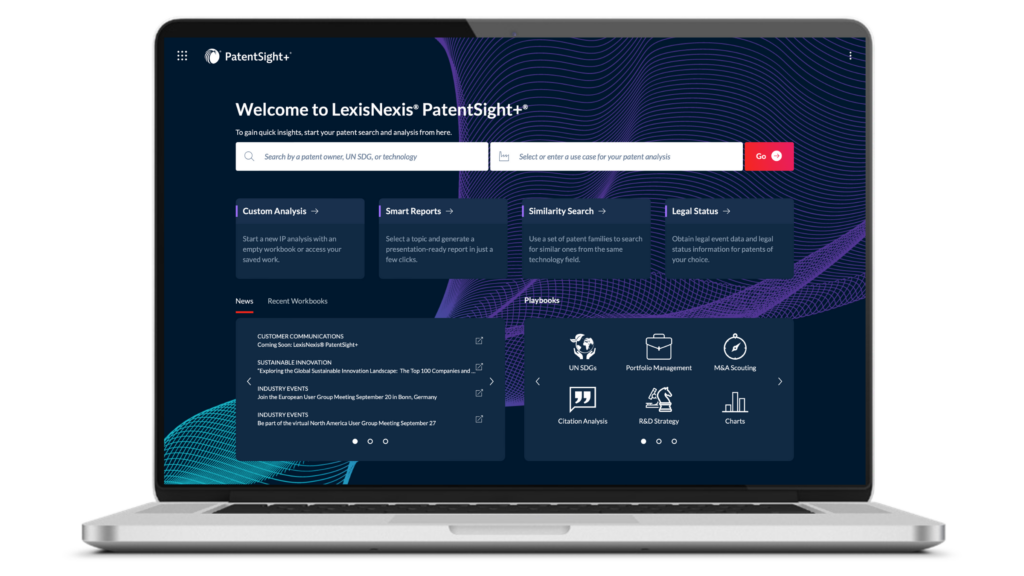

LexisNexis® PatentSight+는 고도로 선별되고 풍부한 데이터세트, 최첨단 분석 도구, 간소화된 워크플로우 및 강력한 시각화 기능을 모두 단일플랫폼 내에 통합하여, 경쟁 인텔리전스, 포트폴리오 최적화 등과 같은 핵심 IP 활동을 강화할 수 있도록 상황에 맞는 객관성을 제공함으로써, 전략적 의사결정자가 리스크를 최소화하고 IP 가치를 극대화할 수 있도록 지원합니다.

IP 워크플로우 최적화 및 고객의 전략적 비즈니스 의사 결정을 지원

저희는 데이터, 분석 및 첨단 기술의 통합으로 기업, 연구원, 로펌,

특허 당국, 대학 및 금융 회사에 서비스를 제공합니다. 정보에 기반한

결정을 내리고 생산성을 높이며 규정 준수하고 궁극적으로 성공적인

결과를 얻을 수 있도록 지원합니다.

IP 개선 및 혁신 가속화

고객 중심인 당사는 IP 산업의 발전을 지원하기 위해 헌신하고 있습니다. 고품질과 포괄적 IP 데이터를 위해 헌신해 온 당사는 많은 국가의

특허청을 위해 신뢰받는 조언자 역할을 하고 있으며, 50년 이상

USPTO에 서비스를 제공하여 특허 프로세스를 디지털화하고

능률화하고 있습니다.

1억 5천만

건의 특허 문서

50년 이상

USPTO에 서비스 제공

100+

개 이상의 엄선된 기술 분야

모든 IP 요구 사항을 충족하기 위한 솔루션

특허 검색

LexisNexis TotalPatent One®은 세계 최고 수준의 기록 보관소 및 가장 많은 수의 특허 당국들과 고성과 기술을 연계하여

효과적인 특허 검색을 수행하고 확신할 수 있는 비즈니스

결과를 지원합니다.

미국 출원 절차 분석

LexisNexis® PatentAdvisor®를 통해 고객의 특허 출원 절차에

예측 가능성과 생산성을 부여합니다. 진보된 심사관 분석을

통해 최상의 출원 절차 전략을 구현하여 시간과 비용을

절약하세요.

IP 분석

LexisNexis® PatentSight®와 함께 더 효율적인 IP 관리자가

되세요. 전 세계 특허 포트폴리오에 대한 통찰력을 확보하여

관련 특허 및 기술 트렌드를 파악하며, 경쟁 전망을 평가하고,

파트너 및 라이선스 기회를 찾을 수 있습니다.

IP 워크플로우에 명확성과 생산성을 부여

고객이 목표를 달성하도록 돕는 것이 우리의 우선순위입니다. 우리는 혁신가들이 정보에

기반한 결정을 내리고 생산성을 높이고 궁극적으로 더 나은 결과를 얻을 수 있도록

지원함으로써 더 많은 것들을 성취하게 합니다.

서비스 제공중인 주요 업계

고객 사례

고객들이 어떻게 고급 데이터와 분석을 활용하여 IP 성과를 개선하고 있는지

알아보세요.

LexisNexis® PatentSight® Enhances M&A Decision Making With IP Due Diligence Insights

McBee Moore & Vanik IP leveraged LexisNexis® PatentSight® to run comparative analysis for M&A decision making.

How Skai Analytics Uses Patent Data to Find Market Trends Early

Skai Analytics develops a data tool for companies that are looking for profound insights on the latest market trends.

Increasing Patent Portfolio Strength and Patent Income at Siemens

Learn how Siemens leverages LexisNexis® PatentSight® to increase their patent portfolio strength and patent income.

European Commission’s DG-Comp Relies on LexisNexis® When Evaluating Anti-trust Merger Cases

European Commission’s DG-Comp selected LexisNexis® PatentSight® as their primary supplier of patent data and patent analytics.

IP 블로그

IP 전문가를 위한 사고 리더십(thought leadership) 콘텐츠

The Rise of Social Media Selling in China Reveals New Brand Protection Threats

Social selling allows brands to find prospects on social media. The rise of this type of selling has created new brand protection threats.

Pop Culture Patents: The Modern Space Race

The modern space race looks much different than in the past. Today the competition is being led by the private sector.

What To Do After a Final Office Action

Patent examiner data and statistics can help patent practitioners develop well-informed strategies after receiving a final office action.

COVID-19 Effect on Pharmaceutical Innovation

Learn about pharmaceutical innovation driving progress on the treatment and prevention of COVID-19, and other biotech contributions.

혁신을 가속화하기 위한 협업

IP 문제 해결을 도와드립니다. 문의하세요.